- For your convenience, we have created a storm damage form/survey to report structural damage to your home and improvements (not fence damage or downed trees)

- If incomplete on January 1 after the damage occurred, appraisers will reduce your market and capped values accordingly as of January 1 for the new tax year

- The reduced value will affect the property tax bill you receive next November (e.g., if your home suffered extensive damaged in Aug 2024 and repairs are complete in Feb 2025, your Nov 2024 tax bill will not include any property tax reduction, it will appear on your Nov 2025 tax bill and the value of repaired/replaced property won’t be taxed until Nov 2026)

- If the repaired or replaced building is no larger than 110% of the former damaged building, no value is added over the capped value that existed at the time the damage occurred

- If the rebuilt square footage is greater than 110% of the building’s original size, only the value attributed to excess square footage is added above the 3% Save-Our-Homes cap or 10% non-homestead cap.

- If the original home was less than 1,500 SF, a maximum of 1,500 SF or 110% of the original, whichever is greater, may be added.

Property Tax Refund

You may be eligible for a property tax refund due to damage associated with the catastrophic event. The following conditions apply:

- The property must have been rendered uninhabitable for at least 30 days from damage associated with a hurricane or other catastrophic event.

- The owner must provide our office a completed DR-465 Application for Catastrophic Event Tax Refund (Section 197.319,Florida Statutes).

- The form must be accompanied by supporting documentation showing the real property could not be inhabited following the date of the catastrophic event.

- This includes utility bills, insurance claims, contractor statements, permit applications, or certificates of occupancy.

Under Florida Law, if a property is damaged or destroyed by misfortune or calamity after the damage or destruction occurs, the property owner may continue the homestead exemption. The owner must notify the Property Appraiser that they intend to repair or rebuild the property and use the property as the primary residence following the completion of repairs. Review the scenarios below to better understand how this may impact your property taxes:

- Elect not to rebuild - The exemption will be removed on the January 1 following the damage and the property owner will have the 3-tax year statutory window to port (transfer) any assessment differential to a new homestead.

- Repair Property owner makes necessary repairs and reoccupies the property. No impact to the assessed value cap.

- Elevate (flooded properties) - If the property owner is able to repair and elevate (lift) the lowest living level of the home above base flood elevation, the value of the newly constructed subarea(s) at grade level will be added above the assessed value cap. The elevated improvements will remain under the cap as long as they do not exceed 110% of the original structure or 1,500 SF, whichever is greater. The affected property owner has 3 years from the January 1 following the damage or destruction of the property to commence the changes, additions or improvements.

- Rebuild - If the property owner chooses to rebuild (up to 110% of original improvement or 1,500 SF, whichever is greater) then the Save Our Homes (SOH) cap or non-homestead cap will continue upon completion of the new building as if no damage occurred. The homestead exemption will remain on the vacant land during construction. However, if the owner chooses not to rebuild after notifying the PAO that they wish to, the SOH cap will most likely be severely reduced. The affected property owner has 3 years from the January 1 following the damage or destruction of the property to commence the changes, additions or improvements. (will increase from 3 to 5 years effective January 1, 2025)

- Below explains how we determine when square footage exceeds the 110%:

- The primary area for a single-family space is labeled as “BAS” (Base heated/living space) and represents the baseline level of finish for the living area of the structure at 100%. This space is the primary living area which includes the kitchen. All other areas, also referred to as subareas, are measured as a percentage of the base area, as their level of finish is typically something less than the Base.

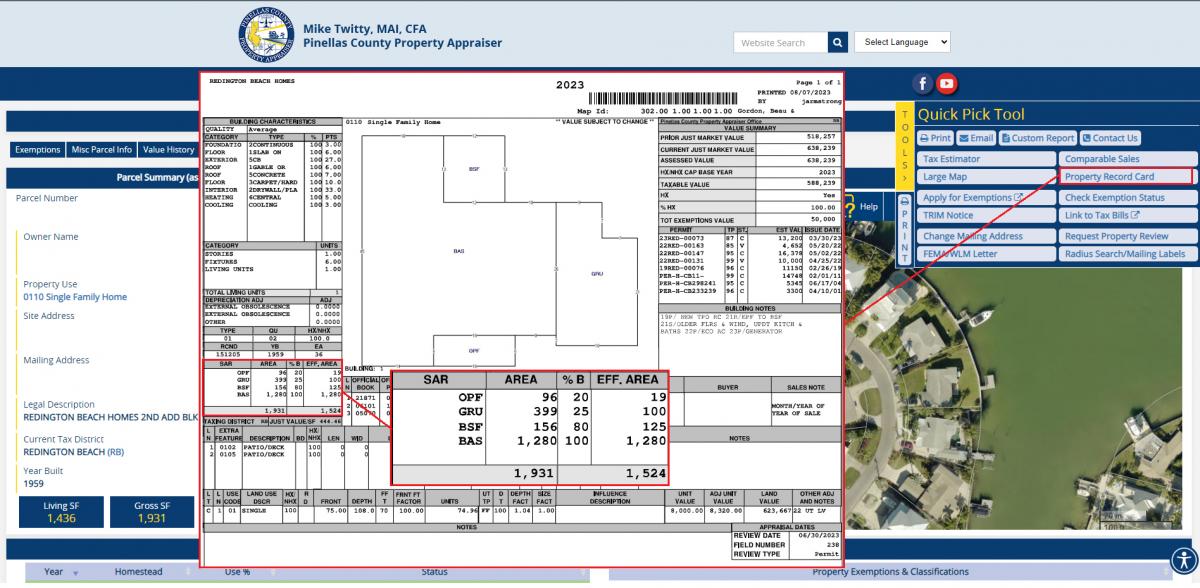

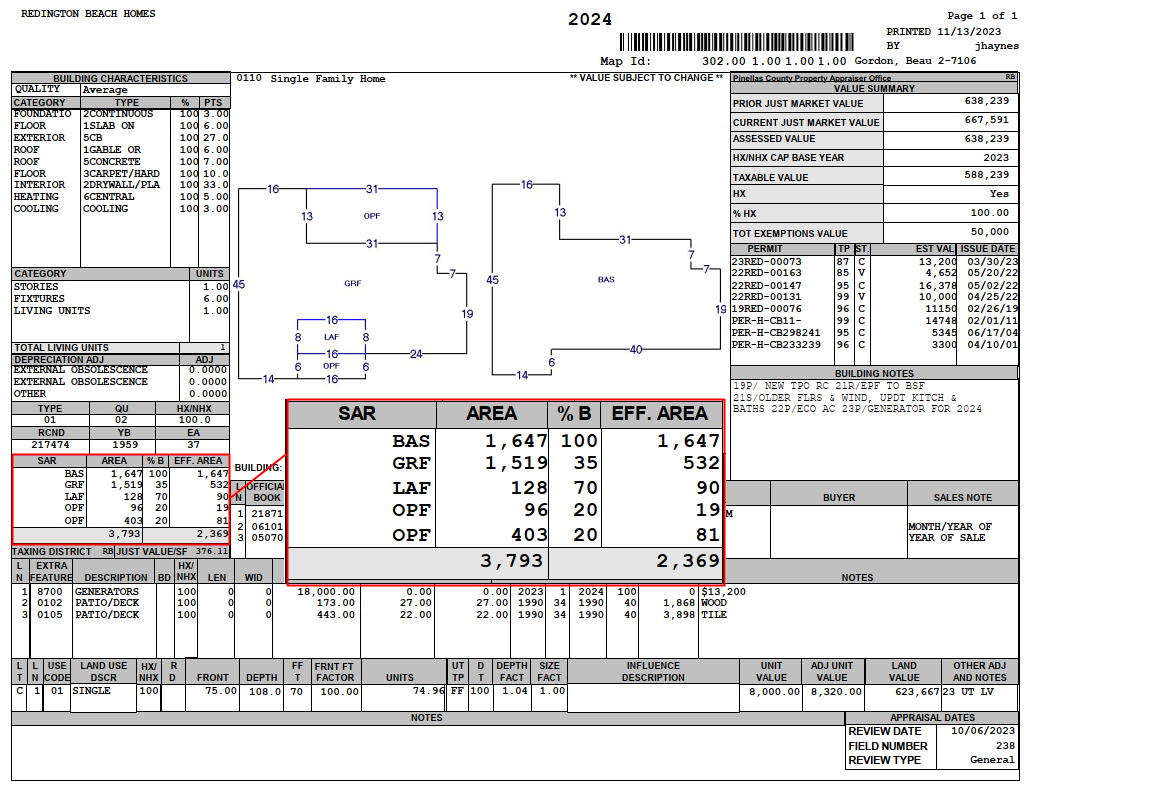

- The description for each subarea “SAR”, gross area “AREA”, percentage of base “%B”, and the effective area “EFF.AREA” for each can be found on the Property Record Card. The effective area takes into account the weighting (as a percent of base) for each subarea. Effective area will always be greater than or equal to your living area since it includes all subareas.

- This information can be found on the Property Record Card which can be downloaded from our website (https://www.pcpao.gov/) from the Quick Pick Tool box. See example (Ex:1) below.

- In the first example below (Ex:1), the effective area prior to the calamity was 1,524 sqft. Accounting for the 110% (1.10 x 1,524), the effective area can increase to 1,676 sqft without exceeding the existing capped/assessed value. Any square footage exceeding this amount would add value over the existing capped/assessed value. Graphic Ex:2 below shows the effective area increased from 1,524 to 2,369 sqft. So, the amount exceeding the 110% (2,369 – 1,676) is 693 sqft, and would be valued as new construction above the cap. The cap would then apply to this space going forward in future years under the same ownership.These calculations are also presented in tabular form in row 1 of Ex:3 below.

Example of Rebuilding using Effective Area

- Ex:1

- Ex:2

- Ex:3

Maximum Original Effective SF New Effective SF Allowed SF (under SOH Cap) Excess Area Assessed at Just (Market) Value 110% of the original SF 1,524 SF 2,369 SF 1,676 SF (1,525 x 1.10) 693 SF (2,369 - 1,676) 1,500 SF 1,200 SF 1,600 SF 1,500 SF 100 SF (1,600-1,500) Note: The “Excess Area Assessed at Just (Market) Value” would be the amount not covered by the SOH or non-homestead cap. After being added to the tax roll, this area would fall under SOH or non-homestead cap protection in future years.

The State of Florida, Dept of Revenue has published two informative guides to help inform Florida homeowner’s who have suffered property damage:

- A Florida Homeowner’s Guide: Catastrophic Event Property Damage

- A Florida Homeowner’s Guide: Property Tax Relief for Catastrophic Events in 2023

The loss or damage to your home due to a calamity (hurricane, storm or otherwise) is a devastating experience. The revaluation of your home is possibly the last thing on your mind; but please let us know as soon as you are able so we can help make the process easier.

- Below explains how we determine when square footage exceeds the 110%: